In the complex world of government contracting and spending, understanding the federal fiscal year is crucial. Did you know that the U.S. government employs special programs dedicated to empowering small businesses, ensuring they secure a significant portion of federal contracting dollars annually? Remarkably, the goal is for small businesses to secure at least 23% of the large pool of contracting funds each federal fiscal year.

Additionally, that includes awards to small businesses that are certified in specific socio-economic criteria. Here are contracting dollar award goals set aside for small businesses:

- Small disadvantaged businesses – 12%

- Women-owned small businesses – 5%

- Service-disabled veteran-owned small businesses – 3%

- Small businesses in a HUBZone – 3%

It’s just one fascinating part of a system that sees the federal government entering into an incredible four million new contracts and orders each fiscal year. In this post, we’re sharing everything you need to know about the fiscal year and data to help you take advantage of the contracts available for the 2024 federal fiscal year as well as looking ahead to FY 2025.

What is a fiscal year?

A fiscal year is a period of 12 consecutive months that a company or government uses for financial reporting and budget purposes. A fiscal year enables organizations to analyze and report their financial performances, budgets, and other financial metrics consistently and effectively.

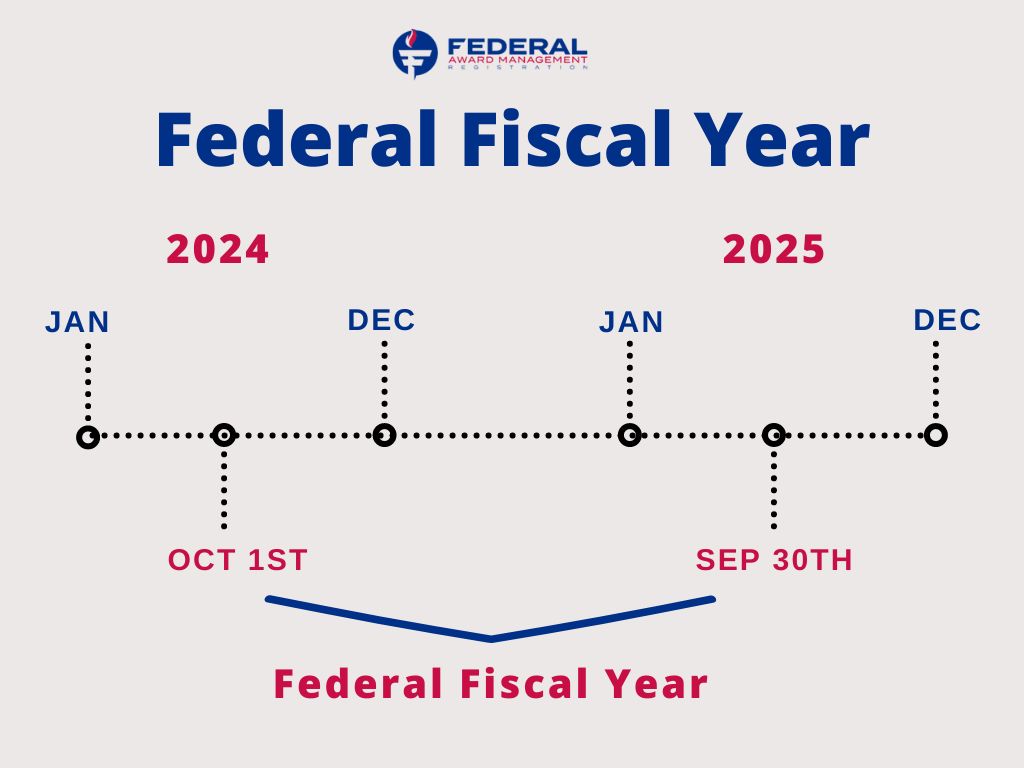

Unlike the typical calendar year (January 1 to December 31), a fiscal year can start and end at any point during the year depending on the organization’s preferences. This choice of those start and end points are often influenced by factors such as tax considerations and reporting requirements. When it comes to the federal government, their federal fiscal year starts on October 1st and ends on September 30th the following year.

When does fiscal year 2024 start and end?

When it comes to the federal government, the current federal fiscal year, FY 2024, starts on October 1st, 2023 and ends on September 30th, 2024. In financial reports and statements, the fiscal year is often referred to as the one in which it ends. For example, FY 2024 started in 2023 and ends in 2024.

When does the 2025 federal fiscal year start and end?

The 2025 federal fiscal year in the United States starts on October 1, 2024, and ends on September 30, 2025. Unlike the calendar year which runs January 1 to December 31, the federal fiscal year does things a bit differently and starts on October 1 and ends on September 30 of the following year.

History of the federal fiscal year calendar

The purpose of the federal fiscal year calendar is to establish a standardized 12-month period to serve as the framework for the U.S. government’s budgeting, financial planning, and reporting processes. The federal fiscal year contributes to effective governance and financial stability by:

- Facilitating congressional budgeting.

- Aligning economic cycles.

- Ensuring consistency in financial reporting.

- Aiding in the coordination of activities with state and local governments.

While its purpose has mostly stayed the same, the history of the federal fiscal calendar in the United States has undergone several changes since the country’s founding days.

In the early years, the federal government simply followed the calendar year for financial and budgetary purposes. Then in 1842, the federal government shifted its fiscal year to a July 1st to June 30th cycle. This change aimed to better align the fiscal year with the agricultural production cycle, as many taxes were based on agricultural activities.

There wasn’t another change to the federal fiscal calendar until The Congressional Budget and Impoundment Control Act of 1974. The current federal fiscal year, which begins on October 1st and ends on September 30th of the following year, has remained unchanged since the bill was enacted in 1976. This date provides more time for Congress to make budgetary decisions and helps to avoid disruptions with transitioning budgets at the beginning of a calendar year.

Why the 2024 federal fiscal year matters for contractors

As a contractor, it’s highly beneficial to closely monitor federal budgetary developments to make informed decisions that will contribute to their success in the federal marketplace. In general, the federal government spends the most money on federal contracts during the first and last quarter of the fiscal year (July to December). According to research, federal agencies spend nearly 70% of their budgets before the start of Q4, which leaves around 30% of all fiscal year funds available to government contractors in the “Q4 Sprint”.

To better understand the potential for contractors in FY 2024, here are some numbers from last year’s federal spending:

- On December 23rd, 2022, Congress passed a $6.1 trillion budget for FY 2023.

- The federal government awarded over 5,357,500 contracts in total.

- The Small Business Administration awarded over $382 million in awards.

- The Department of Defense spent $36.7 billion in contractual services and supplies.

Biggest takeaways from the proposed Federal Fiscal Year 2025 Budget

In March 2024, the Biden-Harris Administration submitted its proposed budget to Congress for the 2024 fiscal year at a total of $7.3 trillion dollars, up from $6.9 trillion in FY24. While we are still waiting for the budget to pass, here are highlights from what’s been proposed that provide the best opportunities for federal contractors:

- The FY 2025 Federal Budget Request is the largest one yet and outlines the major priorities of the Biden Administration, including public health, cybersecurity, climate change, and technology advancement which present opportunities for small business contractors.

- The DoD’s budget request focuses on programs, technology, and R&D that address the top national security concerns, particularly regarding China and Russia.

- The Administration continues to push for a clean energy future with investments in R&D, fusion energy, and climate resiliency efforts so if you’re in this industry, FY2025 could be a year of great opportunities!

Protecting critical material supply chains and boosting domestic manufacturing are key priorities and contractors can support supply chains and grow domestic production capabilities.

6 key proposals from the previous 2024 fiscal year budget

If you’re curious about the most recent proposal and how it stacks up to last year, here are some of the key takeaways. In March 2023, the Biden-Harris Administration submitted its proposed budget to Congress for the 2024 fiscal year at a total of $6.9 trillion dollars. Here are highlights from the proposed government budget that provide great opportunities for federal contractors:

- $842 billion for the Department of Defense (DoD), up 3.2% from 2023.

- At a record high, the Environment Protection Agency (EPA) has a proposed budget of $12.1 billion, with $219 million specifically allocated for lead service line replacement.

- $175 billion has been requested to expand housing supply and improve access to affordable rental options.

- $60.4 billion has been proposed for the Homeland Security budget.

- $2.7 billion is being budgeted for expanding the health workforce and addressing shortages in the industry.

- The proposed FY 2024 is requesting $1.67 billion for the Bureau of Land Management, with $123.5 million allocated for oil and gas management.

Certify your business and secure more this fiscal year

This guide has provided a deep dive into the complexities of the Federal Fiscal Year and the intricacies of the FY 2024 budget. Understanding the dynamics of government spending, and particularly all of its contracts and awards, is a crucial step for businesses aiming to thrive in this competitive landscape.

To stand out and position your business strategically, take the crucial next step by getting registered and exploring exclusive federal contracts. For personalized assistance tailored to your goals, we can help. Whether you’re a seasoned contractor or a new small business owner, our team of experts is ready to guide you through the intricacies of federal contracting. Your journey to federal contracting excellence starts with us.

Call us today to explore how you can maximize your award opportunities, make a lasting impact, and thrive in the competitive realm of federal contracting.

Why this matters for contractors

As a contractor, it’s highly beneficial to closely monitor federal budgetary developments to make informed decisions that will contribute to their success in the federal marketplace. In general, the federal government spends the most money on federal contracts during the first and last quarter of the fiscal year (July to December). According to research, federal agencies spend nearly 70% of their budgets before the start of Q4, which leaves around 30% of all fiscal year funds available to government contractors in the “Q4 Sprint”.

To better understand the potential for contractors in FY 2024, here are some numbers from last year’s federal spending:

- On December 23rd, 2022, Congress passed a $6.1 trillion budget for FY 2023.

- The federal government awarded over 5,357,500 contracts in total.

- The Small Business Administration awarded over $382 million in awards.

- The Department of Defense spent $36.7 billion in contractual services and supplies.

6 key points from the proposed 2024 fiscal year budget

In March 2023, the Biden-Harris Administration submitted its proposed budget to Congress for the 2024 fiscal year at a total of $6.9 trillion dollars. Here are highlights from the proposed budget that provide great opportunities for federal contractors:

- $842 billion for the Department of Defense (DoD), up 3.2% from 2023.

- At a record high, the Environment Protection Agency (EPA) has a proposed budget of $12.1 billion, with $219 million specifically allocated for lead service line replacement.

- $175 billion has been requested to expand housing supply and improve access to affordable rental options.

- $60.4 billion has been proposed for the Homeland Security budget.

- $2.7 billion is being budgeted for expanding the health workforce and addressing shortages in the industry.

- The proposed FY 2024 is requesting $1.67 billion for the Bureau of Land Management, with $123.5 million allocated for oil and gas management.

Certify your business and secure more this fiscal year

This guide has provided a deep dive into the complexities of the Federal Fiscal Year and the intricacies of the FY 2024 budget. Understanding the dynamics of government spending, and particularly all of its contracts and awards, is a crucial step for businesses aiming to thrive in this competitive landscape.

To stand out and position your business strategically, take the crucial next step by getting registered and exploring exclusive federal contracts. For personalized assistance tailored to your goals, we can help. Whether you’re a seasoned contractor or a new small business owner, our team of experts is ready to guide you through the intricacies of federal contracting. Your journey to federal contracting excellence starts with us.

Call us today to explore how you can maximize your award opportunities, make a lasting impact, and thrive in the competitive realm of federal contracting.